The Simplest Guide To Getting Started With Cryptocurrency

*This is not financial advice. This is a guide to help people out on getting started with crypto and should not be misconstrued as me giving you advice on how to spend or invest your money.*

Getting Started and Purchasing Your First Bitcoin, Ethereum, or Litecoin In Coinbase

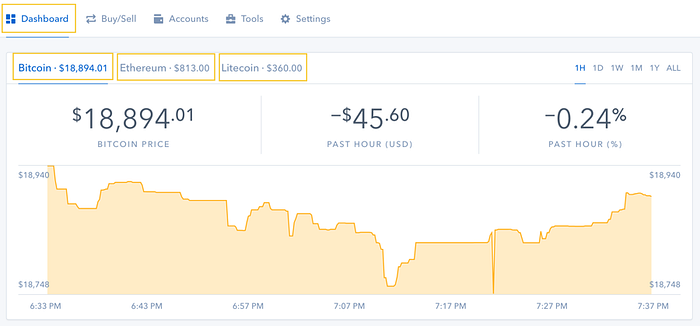

Before you get started and buy anything, you first need to verify your identity. When everything’s been verified, you’ll land on your dashboard:

Here, you can view the charts on Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, as well as a quick history on cryptocurrencies bought, sold, sent, and received. But before you can buy anything, you’ll need to link your bank account or credit card.

Linking A Bank Account or Debit/Credit Card

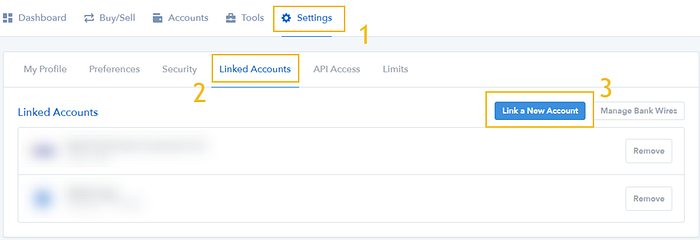

Click the “Settings” button. Then, click Linked Accounts, and then click “Link a New Account”.

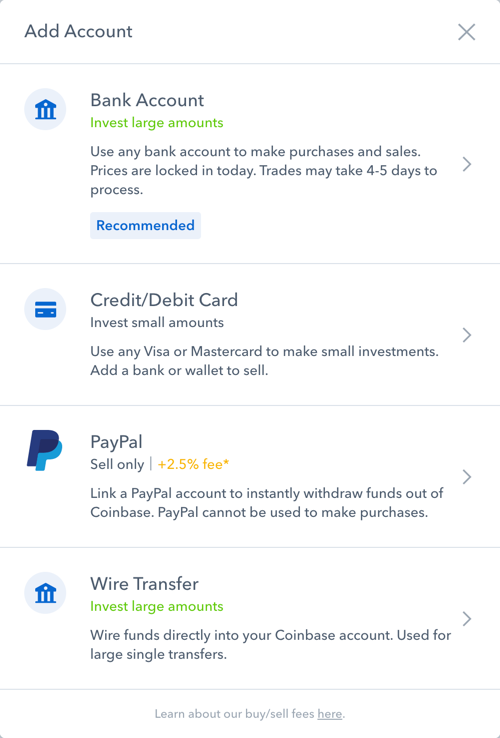

A popup like this will appear:

You can use your credit/debit card, or you can also link your bank account. Using your credit or debit card to purchase is quick, but they add an extra fee. Your bank account usually takes about a week, but there’s fewer fees.

In order for Coinbase to verify that you’re actually using an authorized account, they’ll do two small verification transactions (under $1 each). This may be instant if you used your card, or it may take a couple days for your bank account, but if you have online banking, they will generally show up under pending transactions.

Note: Your bank or credit card may deny your transaction from Coinbase initially and place a freeze on your account. It’s a toss-up. Before you proceed to buy anything, I’d recommend calling them up and letting them know that you’ll be making a purchase on Coinbase with that bank account or card. Save yourself that headache of a cancelled transaction.

Buying Cryptocurrency on Coinbase

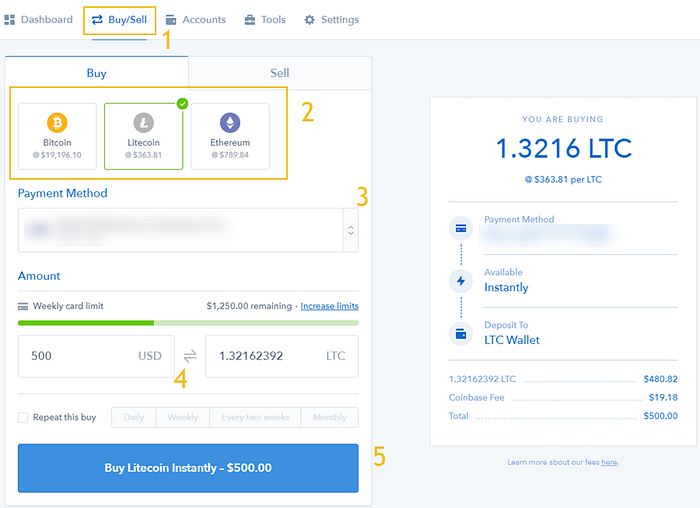

To buy, click the Buy/Sell button at the top of your menu. Second, select which cryptocurrency you want to buy. Third, select your payment method. Fourth, you can type in the amount in USD you’d like to purchase, or you can type in the amount of the cryptocurrency you’d want to purchase.

Note: You can buy in fractions, and DO NOT need to purchase a whole Bitcoin, Ethereum, or Litecoin. As you see in my example enough, you can buy 1.3216 of a Litecoin if you’d like. You can buy 0.005 of a Bitcoin as well. As I write, even that is nearly $100.

Finally, you click that blue button at the bottom. A popup will ask you if you’re sure. If you’ve got 2 factor authentication on, you will need to verify before you can purchase it.

It’s as simple as that!

Exchanges

The exchanges allow you to get into different alternative cryptocurrencies that are not listed on Coinbase.

GDAX

GDAX and Coinbase are from the same people. So if you have a Coinbase account (you have one right? If not, click here to get your Coinbase account setup), then you’ll be able to use GDAX to trade, send, and receive the coins that Coinbase supports with fewer fees. As of this article, they only support Bitcoin, Ethereum, and Litecoin, with plans to add more soon!

Binance

www.binance.com

Binance is one of the largest exchanges out there with one of the greatest selections of markets. It’s one of the more simple exchanges to use.

Sending And Receiving Your Cryptocurrency

Every wallet and exchange has a different setup, so it would be extremely time consuming for me to get into all of them. If you need step by steps on each wallet or exchange, they should have an FAQ section. I’ll show how to send and receive in both Coinbase and Binance.

Sending and Receiving in Coinbase

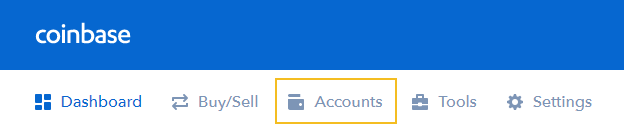

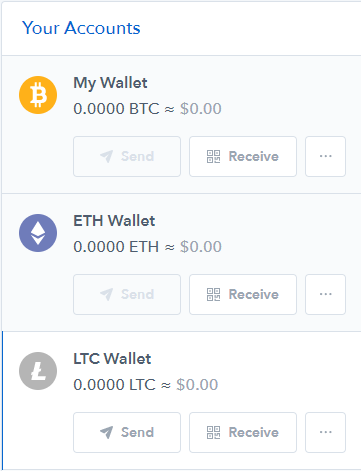

Click the “Accounts” button in your Coinbase Dashboard.

To send, click send and make sure you have the correct address, then input the amount you want to send in USD or the amount you want to send in the respective cryptocurrency in the next box over. To get the address someone can send you some cryptocurrency at, click the receive button. You can get the address, as well as a QR code, that you can receive cryptocurrency at. Make sure you’re only sending Bitcoin to a Bitcoin address, Ethereum to an Ethereum address, etc. If you make a misstep on that, your money could be gone forever.

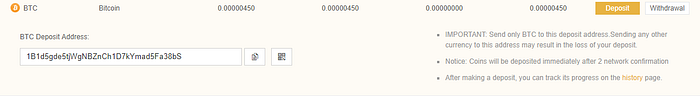

Depositing and Withdrawing in Binance

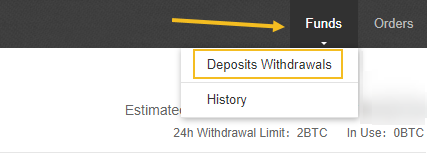

As I mentioned, every wallet and exchange is different, so I wanted to show another exchange. When logged into Binance, look to the upper right and you’ll see the “Funds” button.

Scroll over it to get to the “Deposits Withdrawals” link, and click that.

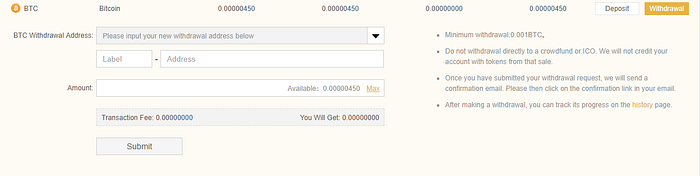

You’ll find their listed cryptocurrencies here, and once you found the cryptocurrency you want to send or receive, click the respective button based on what you’re looking to do.

If you want to withdraw from this account and put it into another account, put the other wallet’s public address in the address key, and the amount of the respective cryptocurrency you want to send over. Then click submit.

To receive, click the “Deposit” button. Copy and paste that address wherever you’re looking to transfer from. (Say for example you want to send some Bitcoin from Coinbase or GDAX to Binance to buy some IOTA or Cardano.)

Note: Copy and paste the address you’re sending to. Double check after you’ve pasted it to make sure it’s correct. Triple check, slowly. If one thing’s wrong, your money could be gone forever.

Another note: Sometimes, sending and receiving can take a while. In some cases, Bitcoin has been known to take a day to transfer. Ethereum tends to be quicker, but with its rise of popularity, it’s seen some network congestion. Don’t freak out if it takes a while. You’ll get notifications from both Coinbase and some exchanges like Binance when it’s been received and sent successfully.

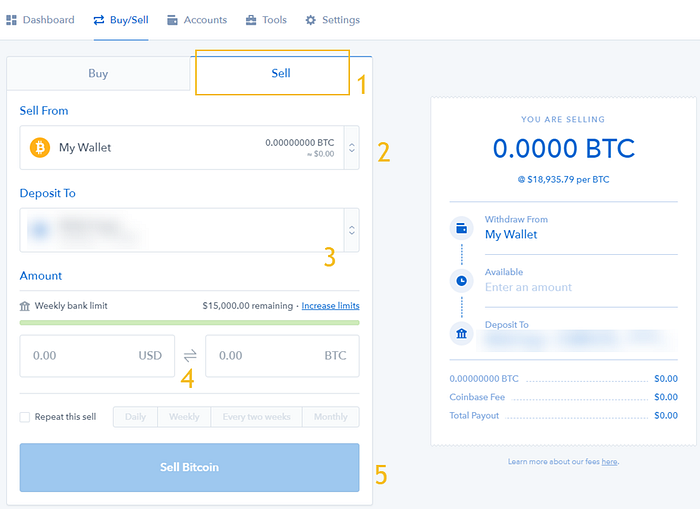

Selling Your Cryptocurrency in Coinbase

With your bank account or Paypal account linked, you can sell as much cryptocurrency as your weekly withdrawal limit allows.

In “Buy/Sell”, click the “Sell Tab”. Choose which wallet you want to sell from, and where you want to deposit to. The fourth step is inputting either the amount in USD that you want to sell, or the amount of cryptocurrency you want to sell. Finally, click that blue button, and sell!

Security

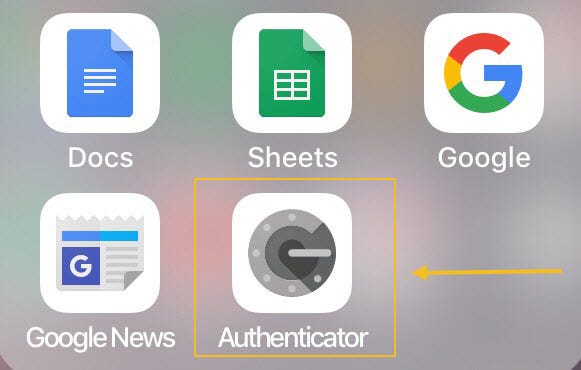

2 Factor Authentication

2 factor authentication, in a nutshell, provides an extra layer of security on your accounts by means of you manually verifying that you’re actually the one logging in.

There are two ways you can apply 2 factor authentication on your accounts (of course, depending on what option the site allows):

- Via SMS. You’ll receive text messages to your phone number when you try logging in or making a transaction.

- Via an authenticator application. Some exchanges and applications allow Authy, but the vast majority use Google Authenticator. They are both apps that you can download on your phone. Keep the information handy that they give you upfront to being able to disable 2 factor authentication, because you’re out of luck if you lose or break your phone. Your old phone’s authentication will not work on your new phone unless you set up 2 factor authentication again.

2 factor authentication is a must, and an authenticator app like Google Authenticator is the most secure.

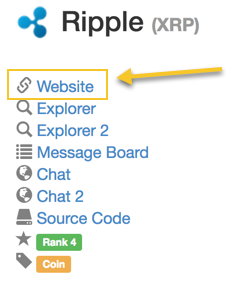

CoinMarketCap

CoinMarketCap will be your cryptocurrency go-to for just about everything. Here, you can see the market capitalization, the current price, the circulating supply, total supply, and historical charts with prices relative to USD, BTC (Bitcoin), and ETH (Ethereum).

The Company’s Website

This is ground zero for all your research, and where you’ll be able to get information such as their whitepaper. Your safest bet is going to CoinMarketCap, selecting your coin of choice, and selecting their website in the left side of the screen. See an example below.

Forums

Forums such as BitcoinTalk are not just about Bitcoin anymore. You can find a fair amount of valuable information here.

The place to start would be the CryptoCurrency subreddit as they talk about all cryptocurrencies. There’s some comedy such as memes, but you can find a lot of questions, ask your own questions, and contribute to some very focused discussions.

Social Media

Via CoinMarketCap, you can find some of your favorite coins’ Twitter accounts and follow them. You can also find great groups of like minded folks on Facebook groups where people discuss trading strategies, price predictions, etc.

LinkedIn is also a very good social media network to connect with people investing in cryptocurrencies as well.

Mining

For most average people, buying and building a computer setup with large clock speeds and the best GPU on the market isn’t too economical. It uses a lot of energy and may be too complicating to set up.

Mining rewards get more and more sparse as time goes on, as is the case with Bitcoin. With an expensive rig and lots of energy spent, it can take over a month to mine just one Bitcoin. Hardly worth it for Bitcoin, but much more attainable with other coins.

However, if you are determined to take part in mining for cryptocurrencies as opposed to outright purchasing them, consider a cloud mining service such as Genesis Mining. You pay a one time fee and slowly earn your desired cryptocurrency over two years (or whatever the contractual agreement may be.) I only can recommend this if you feel that the cryptocurrency’s value will go up a lot in that time frame. Otherwise, it could just end up being a slow way to gain over the course of two years instead of buying upfront and realizing those gains in that same time frame.

Terminology You Should Know

When doing your research, you’ll see so much terminology thrown around that you’ve never seen before. Once you learn what they mean, you’ll get used to the terminology, and it’ll make your research easier and more enjoyable.

Crypto

This simply refers to cryptocurrencies or the cryptocurrency market, depending on the context.

Fiat

Currency issued by a government, such as the US Dollar, the Euro, or Pounds.

ATH

All time high. The highest price the coin/token has ever achieved.

HODL

Simply means “hold”. It was misspelled on a forum years back. Some will say that it means “hold on for dear life,” which works as well.

Shill

This is when a person or company acts in their own self interests and promotes a coin, token, or project wholeheartedly. They focus only on the positive and tend to ignore or downplay any negative concerns.

FOMO

Fear of missing out. People will see uptrends in the charts, lots of volume being traded, or news and don’t want to miss out on making gains. This can sometimes work for or against people and can result in panic buys, thus causing a temporary spike up in cryptocurrency prices.

FUD

Fear, uncertainty, and doubt. This is essentially the opposite of “shilling” and causes a lot of negative feelings towards a coin, token, or project. This can cause dips or crashes in prices.

To The Moon / Mooning

When someone says “to the moon!” they generally mean that the price is going to shoot way up. Same thing with “mooning” — If the price has spiked significantly, you can refer to that level as mooning.

Bull / Bullish

Just like in stock market terminology, a bull run, bullish market, or bullish trend is when prices are going very well. It can also refer to the future expectation that prices will increase.

Bear / Bearish

The opposite of bull / bullish. A bear market or bear trend is when prices are not going well and can refer to the future expectation that prices will decrease.

ICO

Initial coin offering. Just like a company’s IPO (initial public offering), this allows people to get people in on investing in a coin or token before it’s released to the mass public via exchanges.

Market Cap

Circulating supply of the coin or token multiplied by its current price.

Tips

I’ve made many good decisions since first investing in cryptocurrencies, but I’ve also made mistakes. I’ve also heard of a lot of other people making mistakes. The entire point of this guide was to make it easier for you, and for you to minimize your mistakes. If I save one person the headache of having to figure something out where there was no simple source, I’ll have considered this guide a success. So, to end this guide, I want to offer some final tips.

Never invest more than you’re willing to lose

Do not bet the money you’re counting on to pay rent. Do not take your life savings and dump it into cryptocurrency. Of course, things could work in your favor. But it’s certainly not worth the headache you’d be causing yourself by having to stress about crucial money and whether or not you’ll lose money.

Take a break here and there

Yes, it can be very exciting to see your portfolio tracker go higher and higher, but don’t make it your life’s mission to check every fifteen minutes. Unless you’re a day trader, it’s not healthy to check in all the time. Instead, check your portfolio a few times a day or less, and you’ll be able to sleep better.

Help people when you can with any knowledge you may have picked up along the way. Pay it forward.